Get To Know Your Customer Needs Through Primary Research

If you don’t understand your customers, how can you make them happy? If you don’t know what they really want, how can you meet their needs? And if they are not happy and you aren’t meeting their needs, how can you grow your business?

Consider primary research.

At marketing firms like Kinetic, primary research is conducted to obtain data on customers directly from them, not through some secondary market survey. Primarily through controlled, customized interviews with current or prospective customers or clients, researchers discover insights on how individuals view your product, service or bold new idea. Business owners get perspectives from customers that they can’t get from their day-to-day interactions.

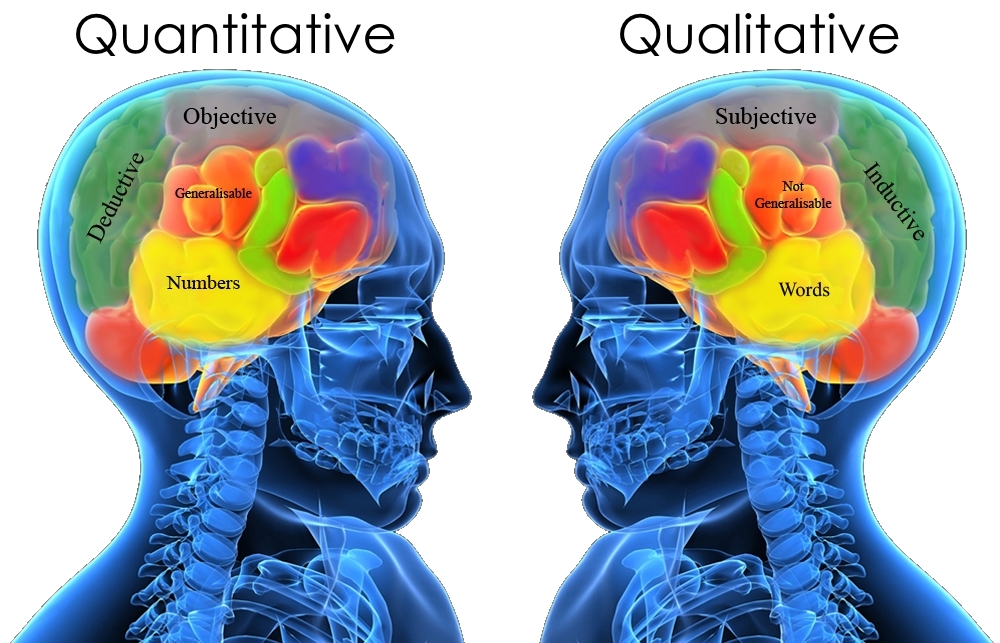

Two forms of primary market research are common today – qualitative and quantitative research. They play complementary roles to:

- Assess current market position

- Gauge expansion prospects

- Show a need for a product

- Validate a product concept

- Identify potential customers

- Identify competitors

- Raise objections to a product

QUALITATIVE RESEARCH

Qualitative research uses open-ended questions to probe customers’ hopes and goals, what they want and, importantly, what they don’t want. If you only ask their opinions about the products you offer, you won’t learn what products you are missing and why some customers don’t give you the time of day.

When our interviewers conduct primary research, they pose specific, personal, open-ended questions to probe the “What is difficult for you?” and “What would make your life easier?” questions that rarely get asked. Follow-up questions often provide invaluable day-in-the-life-of-a-customer responses. With tools like Skype, Zoom and Google Hangouts, the in-depth interviews do not have to be in person.

Perhaps customers say they truly love your coffee shop’s lattes (hooray!), but the in-store and drive-thru waits are just too long for them to make it to work on time. (Maybe with more staff or training you could serve more customers during the morning commute?)

Maybe you learn that the frustrated insurance broker you support says she just can’t deliver the healthcare data a prospective client needs from her. (Perhaps YOUR firm can provide that data to help your broker-client land that new customer. This really happened! See our case study!)

Some candid responses from customers often surprise business owners (“Oh, I would never have imagined that!”). They think they know their customers, but just how well? If owners act on that feedback, customer loyalty may soar.

Other primary research techniques include targeted surveys, field tests, focus groups and observational analysis. All have value, but all have limitations.

Targeted surveys lose the personal, free-wheeling conversation that often reveal deep truths. Field tests and focus groups may be an efficient way to capture information and record observations of respondents. There’s a natural conversation with a focus groups when done right – with good questions prepared and a good mix of folks in your target audience.

But these methods can be expensive and require experienced facilitators and a lot of setup time. Also, sometimes focus-group conversations go off on a tangent or become homogenized if groupthink suppresses more pointed individual opinions.

Observational research records behavior using a video camera or biofeedback system to observe people’s actions (they can vary widely) and collect data. Heat maps or eye-tracking software can show in real time how participants are interacting with a website or social media channels.

QUANTITATIVE RESEARCH

Quantitative research is less free form. It is more structured, often relying on survey forms that capture responses that are translated into data that can be analyzed. If you like numbers and statistics, this kind of research produces it for decision-makers to pore over.

Businesses hope that the data from a larger sample size or population provide rich information that will suggest actions they might take to better meet customer needs. This research quantifies thoughts and behaviors and can be used to test and validate hypotheses.

Questions are usually close-ended and require a “yes/no” or multiple-choice response. Others have a checkbox, rating scale or Likert scale, such as those with five options between “strongly agree” and “strongly disagree.”

Some surveys are open-ended and ask survey takers to write out their responses. But those surveys require much more time to tabulate, may not be easily analyzed and therefore may not reveal trends you are hoping to identify.

In conducting surveys, the questions have to be unambiguous. You need to identify the target audience and get the surveys into the hands of those people or risk having results that are tainted by survey takers who really didn’t belong in the survey.

We also employ experimental research, also called usability testing, to gauge audience reactions to different versions of digital advertising or email campaigns. These A/B tests sent to similar audiences may reveal which version has the most engagement. Usually only one prominent feature in an A/B test is changed, providing a measure of control to the experiment. The focus may be on using user tasks involving navigation, presentation, content or interaction.

There are many ways to gather valuable research. All the strategies require good planning and thoughtful questions if you are going to reveal the customer insights you are looking for.